The City of Hampton, Virginia, this month became the third U.S. community to issue an Environmental Impact Bond (EIB). The other bonds were issued in 2016 and 2019.

Hampton’s EIB will enable stormwater professionals to construct three major green infrastructure projects valued at about $12 million, according to a December release from the city.

“This environmental impact bond demonstrates our commitment to seek out innovation in financing, as well as innovation in implementing projects that make our city more livable and more beautiful while reducing flooding and pollution,” said Hampton Mayor Donnie Tuck during a December 4 virtual press conference. “The pilot projects funded by this bond represent environmentally sensitive approaches to slowing and storing water. They also create neighborhood assets with multiple public benefits designed to enhance our quality of life.”

De-Risking Green Infrastructure

Many investors see green infrastructure as risky because of its case-by-case effectiveness and the difficulty of assigning financial values to its many co-benefits, such as reduced urban noise, cleaner air, and increased biodiversity. EIBs, a financing concept introduced by social investment firm Quantified Ventures (Washington, D.C.) in 2016, makes the prospect of investing in green infrastructure more attractive by tying financial returns directly to measurable outcomes.

The process begins when a public utility or other environmental service provider issues a bond for a potential infrastructure project. Along with the bond, the utility sets measurable, performance-based targets — for example, a specific amount of stormwater detained in a particular radius or fewer air-and-water contaminants — as well as a timeframe for achieving them.

Investors purchase the bond, providing up-front capital for new infrastructure projects. After a predetermined period, an independent party assesses whether the project successfully met its targets. If so, the investors receive a bonus payout in addition to recouping their original investment. If not, they pay the utility an additional fee to help offset its losses.

The model intends to provide extra incentives for investors interested in enhancing community welfare while providing utilities the financial flexibility to make green infrastructure more desirable, Quantified Ventures describes on its website.

“We applaud Hampton’s leadership, creativity, and dedication to building a more resilient city in issuing this EIB,” said Eric Letsinger, Quantified Ventures CEO. “Their commitment to community equity and involvement is second to none.”

The Chesapeake Bay Foundation (CBF; Annapolis, Maryland) and Quantified Ventures worked alongside the Hampton municipal government to develop the EIB, supported by the Kresge Foundation (Troy, Michigan) and an anonymous CBF donor. Unlike previous EIBs structured by Quantified Ventures — alongside DC Water (Washington, D.C.) in 2016 and Atlanta, Georgia, in 2019 — investor outcomes will not scale with the projects’ performance.

Flood-Proofing Hampton

The bond was sold on the open market by underwriters Morgan-Stanley and Wells Fargo. According to the bond’s terms, the three large green infrastructure projects funded by the investment will add at least 32.5 million liters (8.6 million gallons) of local stormwater storage capacity to the Newmarket Creek watershed upon completion.

Newmarket Creek winds in a twisting path through the center of Hampton, bordering the city’s central business district, several dense residential neighborhoods, and a nearby U.S. Air Force base. Recently, severe weather and rising sea levels have increased the river’s tendency to flood, prompting officials to explore new ways to enhance the city’s resilience. The city has been working with Quantified Ventures and CBF to design and fund new flood-mitigation projects in Newmarket Creek since 2018.

According to the city, projects funded by the EIB include:

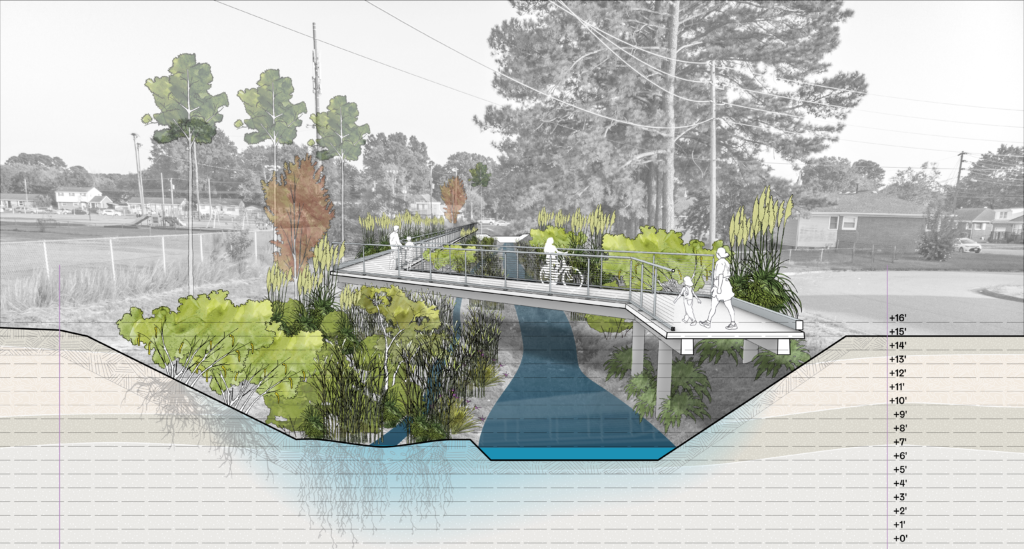

- The Big Bethel Blueway, which will install bioretention cells, weirs, and large amounts of new vegetation along an existing Newmarket Creek drainage channel, aiming to reduce upstream and downstream flooding. After the bond’s initial term, the city intends to further develop the Blueway into a recreation trail with additional green infrastructure elements, according to project documents.

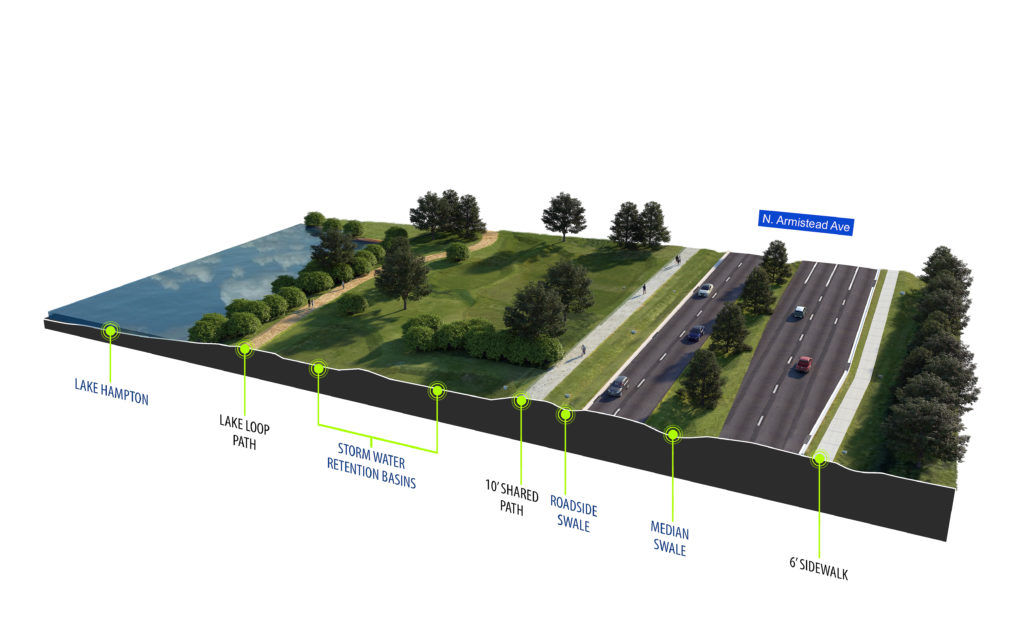

- Increasing the height of North Armistead Avenue, a major Hampton thoroughfare and evacuation route, and installing plants and other green infrastructure along the median and shoulders of the road.

- Transforming an existing detention pond adjacent to North Armistead Avenue into Lake Hampton, a purpose-built “stormwater park” that involves higher dams and weirs in addition to a network of smaller detention ponds and manmade wetlands.